South Africa's Inflation Rates are stable, but the Living Crisis Persists

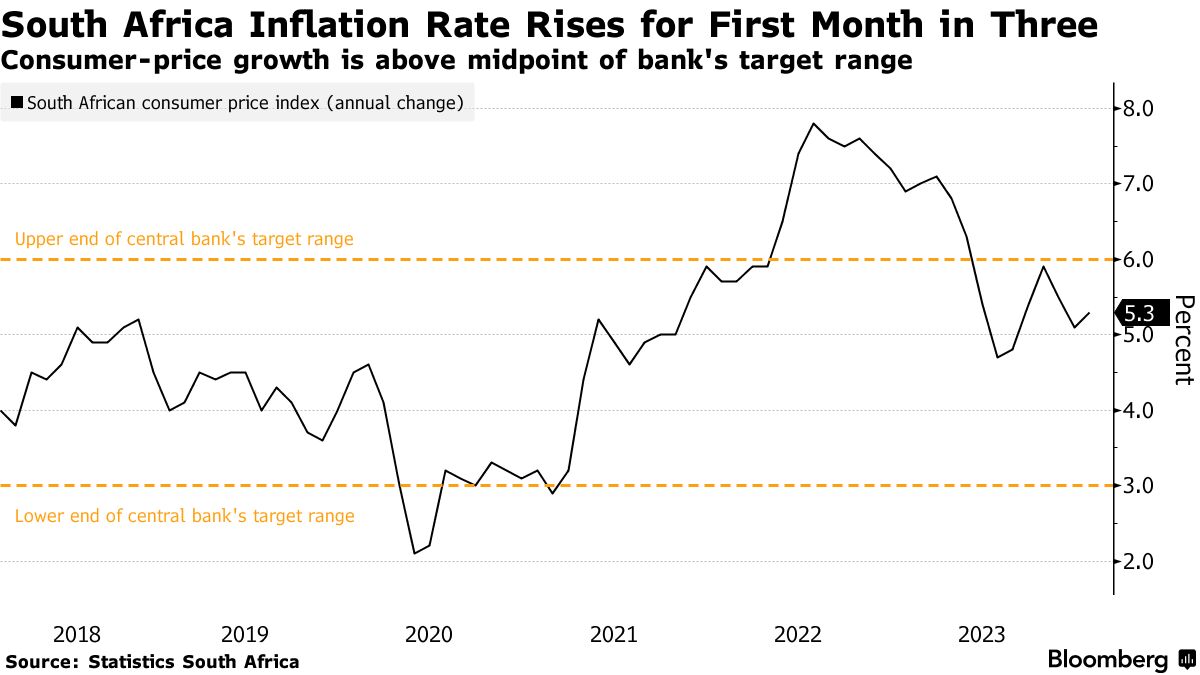

South Africa's inflation rate has been relatively consistent in recent years, due to the South African Reserve Bank's (SARB) attempts to keep prices stable. The SARB has set an inflation goal range of 3-6%, with a preference for managing inflation at the 4.5% middle.

According to the most recent statistics from Statistics South Africa, the consumer price index (CPI) increased by 5.3% in the year ending January 2024. This is within the SARB's target range, indicating that the central bank's monetary policy has been effective in managing inflation. The current inflation rate is mostly driven by price rises in food, non-alcoholic drinks, and utilities such as electricity and plumbing services.

The SARB, responsible for keeping price stability, relies on the repo rate as its major monetary policy instrument to affect inflation. By altering this benchmark interest rate, the central bank hopes to keep inflation within the target range, preferably at the 4.5% figure. The SARB's Monetary Policy Committee (MPC) meets six times each year to examine economic developments and adjust the repo rate appropriately.

Despite the relative stability in headline inflation, South Africans continue to face a serious cost-of-living challenge. Over time, excessive inflation has weakened the purchasing power of cash savings, and the poor have been disproportionately affected as the prices of vital commodities and services, such as food and transportation, have risen.

Furthermore, the COVID-19 epidemic and other economic shocks have compounded the country's budgetary woes, with public debt reaching 71.1% of GDP in 2022. This has limited the government's capacity to offer meaningful social assistance and engage in projects that may foster long-term economic growth and job creation.

The SARB accepts that, while monetary policy may impact inflation, it has little control over the larger economic variables that contribute to the cost-of-living crisis, such as high unemployment, slow economic development, and electricity shortages. Addressing these structural difficulties needs a diverse policy approach that includes the government, the corporate sector, and other stakeholders.

In the meanwhile, the SARB continues watchful in its attempts to keep prices stable. The central bank's inflation forecasts for 2024 and 2025 show that the headline CPI will remain within the target range, albeit at a higher level. However, the MPC will continue to regularly monitor inflation concerns, especially those posed by wage and price-setting behaviour, and modify the repo rate as needed to carry out its mission.