Telkom Bounces Back with Impressive Earnings Growth

The massive South African telecom operator Telkom has shown an incredible improvement in its financial results for the year that concluded on March 31, 2024. The company's efforts to reduce costs and achieve great operational efficiency have resulted in a spike in headline earnings per share (HEPS).

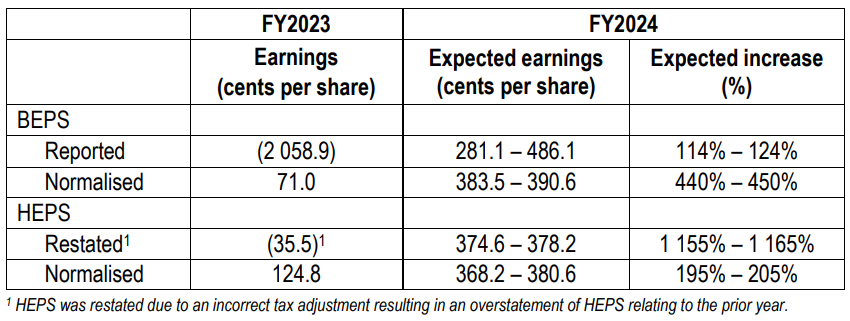

The company's most recent figures show that Telkom's HEPS rose to 376.0 cents, a remarkable 201.3% growth. The main cause of this notable increase in earnings over the prior year was a decrease in write-offs and depreciation. Serame Taukobong, the CEO of Telkom, credited the company's success to its emphasis on providing value propositions to the market, especially in the mobile ecosystem, where it has developed pre-paid products that meet customer demand.

A 10.6% increase in mobile data sales and a 14.5% increase in next-generation NGN fiber data connection revenue drove the company's 1.6% revenue growth to R43.2 billion. With a 10.7% growth in external channel revenue to R4.5 billion, Telkom's Openserve division—which operates in the fixed wholesale connection market—also made a significant contribution to the impressive performance.

The business did not, however, have perfect financial results. Because of the higher loan rates throughout the year, Telkom had to deal with higher net financing costs and fair value movements, which went up by almost 47%. According to the CEO of the company, "higher interest rates increased net finance costs, compared to the prior year".

Additionally, a mistaken tax adjustment resulted in a 9.7 cents per share overstatement in the previous year, forcing Telkom to rewrite its 2023 HEPS calculation. Since then, the business has fixed this problem, proving its dedication to truth and openness in financial reporting.

Telkom's overall financial performance was strong despite these challenges, with a 115.6% rise in free cash flow to R424 million and a 5.2% increase in group EBITDA to R10.0 billion. Additionally, the corporation added 11.9% more mobile subscribers, totaling 20.4 million.

Priorities for Telkom going forward include bolstering its financial sheet through debt repayment and making capital expenditure investments to support future development. Additionally, the corporation has suggested paying out between 30% and 40% of free cash flow as dividends, to implement this plan beginning with the 2025 fiscal year.

Investors have reacted favorably to Telkom's impressive profitability turnaround and its emphasis on strategic projects; the day of the results announcement, the company's share price increased by more than 6% just after the Johannesburg market opened.